There are 8 subjects for CA Final, carrying 100marks each divided into two groups as group- Ⅰ and group-Ⅱ

There are four subjects for CA Final

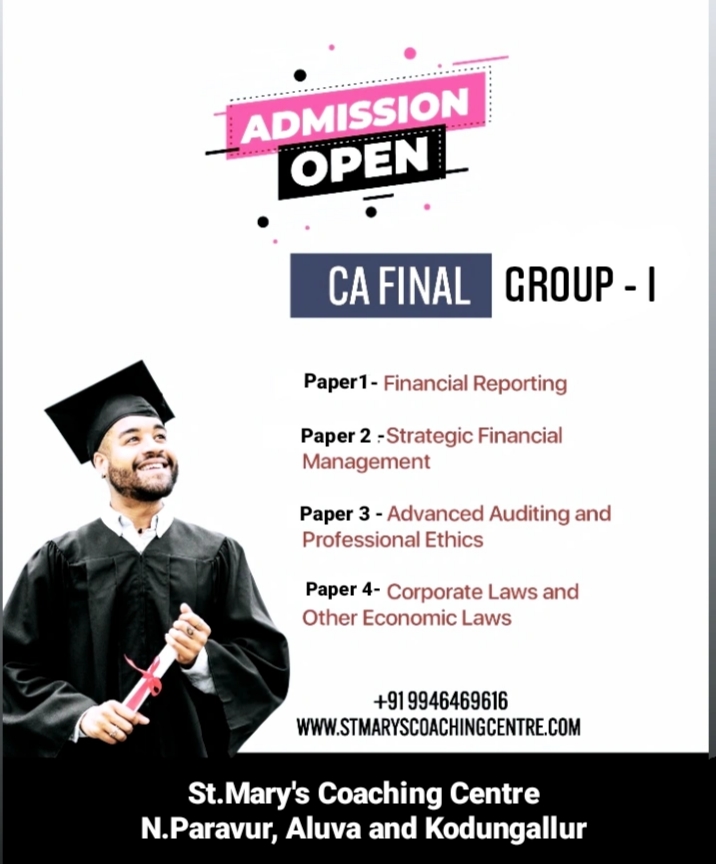

GROUP Ⅰ

PAPER 1- Finical Reporting

PAPER 2- Strategic Financial Management

PAPER 3- Advanced Auditing and Professional Ethics

PAPER 4- Co-Operative Laws and Other Economic Laws

GROUP-Ⅱ

Paper 5-Stratagic Cost Management and Performance Evaluation

Paper 6 –Elective paper (one to be chosen from the list of elective paper) (100marks)

• Risk Management

• Finical Services and Capital Markets

• International Taxation

• Economic Law

• Global Finical Reporting Standards

• Multidisciplinary Case Study

Paper 7 –Direct Tax & International Taxation

Paper 8 – Advanced Internal Tax Laws

The students should have completed minimum 2 1/2 Articleship out of the 3 years of total Articleship before appearing for the CA Final exam .The Students can appear both the group Ⅰ and group Ⅱ at a time or single group. The Students should score 40% in each subject and 50% in aggregate

Rules for Registration

• To register for CA Final the student should have passed both groups of CA Inter

• Registration fee for CA Final Exam (single group/both groups) is RS 22000

• Exams are conducted twice in a year i.e. every May and November. To apply for May exam

registration should be done before October 30 th and for November exam registration should

be done before 30 th April .There must be a minimum gap of 6months between registration

and examination.

• You have to pay RS 500 for each revalidation and each revalidation of registration of CA final

course shall be valid for 5 years from the date of revalidation.

• Exam fee for both groups

3300

• Exam fee for single group 1800

Career Prospects

After completing the CA final, the candidates have wide domains to choose their career. We are listing some of the major domains you can pursue.

1. Practice as a chartered accountant in the company or firm

2. Taxation

3. Management consultancy service

4. Auditing

5. Government Services etc.